Big banks reducing credit card rates

Published April 6, 2020 at 11:45 pm

Canada’s big banks have announced they will be reducing interest rates on credit cards as a way to provide financial relief to those facing financial hardship due to the virus.

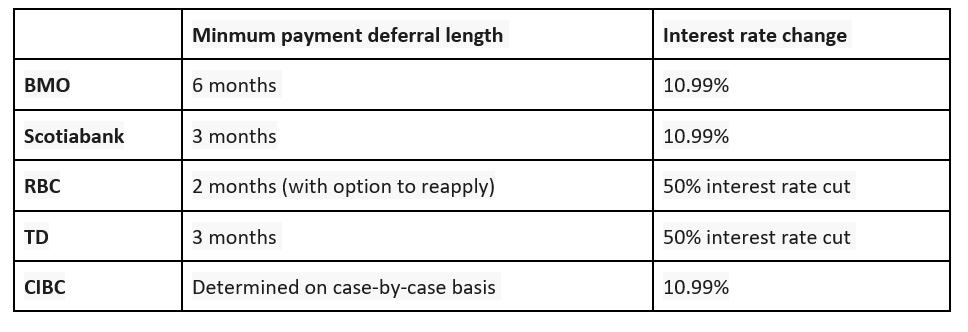

This comes after an announcement that customers could apply for minimum payment deferrals ranging from two to six months depending on the institution.

“We think that it’s a strong signal that banks are putting tactics in place to provide Canadians with a degree of financial relief during these unprecedented times. However, we have to wonder, do these measures go far enough?” Luke Sheehan, VP of marketing at Ratehub.ca, said in a news release.

“There has been a great deal of noise over plans for mortgage and rent payment relief, but with the average Canadian carrying $23,496 in non-mortgage debt prior to the pandemic, failing to make credit card payments can be every bit as devastating, financially,” he continued.

Below are the rates the big five banks, BMO, CIBC, RBC, Scotiabank, and TD:

Based on these numbers, if a customer owed $5,000 on their credit card, and was approved for a three-month deferral they would only pay $136.29 in interest, based on an interest rate of 10.99 per cent, by the end of the deferral period, compared to a payment of $249.81 based on an interest rate of 19.99 per cent.

“We’d like to see more detail on these proposals, specifically concerning what criteria banks are using to determine if customers qualify for payment deferrals and interest rate relief,” Sheehan added.

insauga's Editorial Standards and Policies advertising